In the business of initial public offerings, the global market may be faltering, but primary listing activity in Hong Kong is buoyant. We can point to market-specific factors for this divergence, but we wonder if there is a single overarching theme in play. Could corporate issuers be rewarding Beijing for predictability and stability, at least on a relative basis? For Chinese companies, among others, there may be little incentive to expose themselves to the rough-and-tumble nature of White House policies.

Global IPO volume is now the weakest that it has been in almost a decade, according to data from LSEG. The backdrop may have been dour in the US during the first six months of the year, with IPO volume dropping some 12% year-on-year, but the picture was particularly ugly in Europe, with a 64% decline. Practitioners blame the perceived economic impact of volatile US tariff policies and lingering high interest rates.

Hong Kong should have been impacted by the same criteria. Yet, the equity market there strayed materially from the international setting. In the first six months of this year, Hong Kong was the world’s top listing destination, with about $14 billion in proceeds. For context, companies raised a meager $2 billion in Hong Kong during the same period last year.

From our perspective, there are three strategic issues at play in Hong Kong, while corporate issuers seem to be favoring the measured political approaches of Beijing over volatile upheaval in Washington.

Economic Policy. Investors generally expect that Beijing will up-the-ante on fiscal spending to protect the national economy from global shocks. There of course are other challenges in China, but there is growing talk of a cyclical bottom. A notable pro-business stance after years of regulatory scrutiny is also likely to support capital investment. An elite February meeting between President Xi and prominent Chinese businessmen may have broadcasted a type of public-private reconciliation that was increasingly overdue.

Innovation Capacity. DeepSeek changed everything. The release of this artificial-intelligence company’s low-cost model led to a re-rating of many Chinese startups, with attendant spillover effects on the equity market. Investors realized that hyperscale research and development budgets were no longer a necessary requirement for success, drawing interest to a fresh universe of venture opportunities. In a sign of the times, 40-year-old Liang Wenfeng, founder of DeepSeek, was at that February symposium with President Xi.

Aggressive Marketing. In the post-pandemic period, Hong Kong officials have doubled down on their efforts to lure corporate issuers to this financial center. In an interview just published in the South China Morning Post, Finance Secretary Paul Chan notes, “The number of applications for IPOs in Hong Kong is increasing rapidly… including companies from the Middle East and Southeast Asia.” Propelling enthusiasm is generous stock-market performance. In early July, the Hang Seng Index was up near 22% for the year.

The elephant in this room is concern by Chinese companies over politically-motivated delistings from the US market. Any such move could mean global investors would sell-off these shares, provoking a precipitous price collapse. The delisting issue may fester for some time. As a type of insurance policy against arbitrary White House decisions, Chinese companies already trading on the Shenzhen and Shanghai exchanges are launching secondary listings in Hong Kong.

In these turbulent times, Hong Kong becomes an IPO crossroads, perhaps at the expense of the US. The outlook for NYSE and NASDAQ listings could improve quickly, though, as Washington settles into a more predictable policy cadence. Is that point merely aspirational at a time when Hong Kong may be tethered to a relatively more stable set of policy fundamentals? One signpost: NASDAQ-listed Chime Financial has seen its stock price meander since it debuted in mid-June. For US corporate issuers currently sitting on the sidelines, that lackluster performance may beg a further wait-and-see approach. ■

Our Vantage Point: Companies have wide latitude where and when to list their securities. Propelled by deep capital sources, Hong Kong signals confidence and certainty that is now hard to find elsewhere.

Learn more at the South China Morning Post

© 2025 Cranganore Inc. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

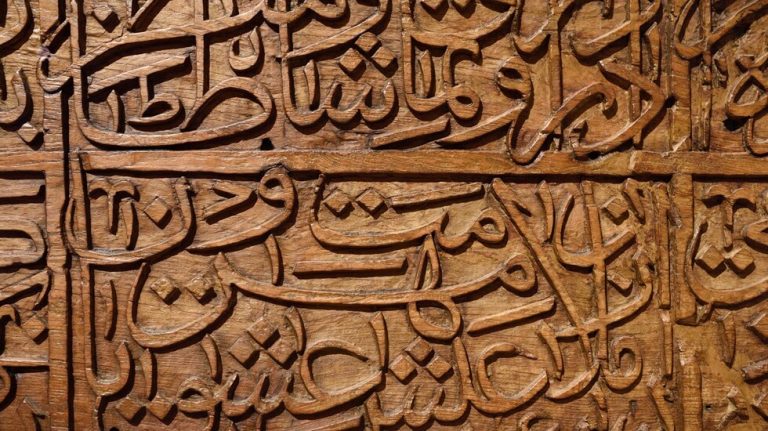

Image shows intersection in Mong Kok. Credit: Urbanscape at Adobe Stock.